What sets you apart? How do you compare to others in your line of work? Why should we invest in you? Impact investors often ask these questions, but don't always have sufficient data with regard to impact to inform their decisions.

Find out how pioneering impact investors use standard metrics to develop an impact measurement system that suits them, as well as their investees.

Measure impact by actually measuring impact

Many impact investors that only measure outputs realize that their investees provide unique services and deliverables. Even though they are all trying to create impact, they often use a different strategy that fits their capabilities, their environment and the people for whom they are trying to create a change.

Measuring impact is hard, but you’ll be rewarded if you stick to measuring what matters and what you actually want to know.

Don’t measure everything

Although we encourage impact measurement, we often advise impact investors against measuring every single indicator that is available. A more sensible way to start would be by developing your theory of change and by checking if some assumptions have already been proven or backed sufficiently by scientific research. Focus on critical assumptions and blind spots and skip irrelevant questions. Last but not least, make sure your impact measurement is practical and of good quality.

Learn from the experience of others

Some impact metrics might be relevant for some investees, but completely irrelevant for others. In other cases, the general impact metrics are insufficient to capture the true impact of unique businesses. In order to find useful impact metrics, familiarise yourself with their definitions and gain knowledge from accompanying studies backing up their relevance, we recommend that you look at popular impact-metric databases.

One of these database - often used by impact investors - is the IRIS database. In this "taxonomy", you can find both output and impact metrics that have been vetted by the Global Impact Investors Network (GIIN). The taxonomy allows selecting a subset of these metrics for specific sectors.

For organisations wanting do an SROI analysis, a good place to start is the Global Value Exchange (GVE), a database containing thousands of stakeholders, outcomes, indicators and valuations.

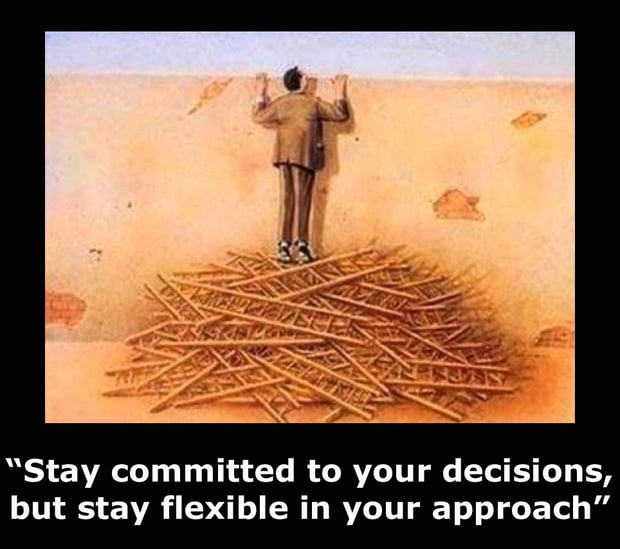

Adapt to change

No measurement system is set in stone and nor should it. In our view, systems and frameworks should allow the option to update indicator sets for all investees at a later stage, should this be required. This enables you to start with simple impact measurements and gradually develop an advanced framework.

Adopt the right language

It can be tempting to stick to technical language or sector-specific jargon in your impact measurement. When collecting data however, it is important to keep in mind that some indicators - and data collection questions linked to them - need an explanation for respondents (e.g. the investees or investment/fund managers) to answer them correctly. Making sure the questions are understandable and clear to those people you need to get information from, can make a difference in your analyses en results.

Would you like to learn more about how we integrated standardizes impact metrics within the Sinzer software tool and how this can be used for due diligence, portfolio management and reporting? Feel free to contact us and request a free demo!

-1.jpg?width=232&name=GT%20Sinzer_logo_screen_descriptor%20(1)-1.jpg)