Impact investing with the purpose of contributing to the Sustainable Development Goals is still in its infancy. One of the main obstacles in this field, is how to measure the impact that these investments create. In order to help the sector achieve some standardization, the Sustainable Finance Platform – chaired by the Dutch Central Bank (DNB) – formed a Working Group on SDG impact measurement.

Asset owners PGGM, APG, MN, Kempen, Achmea, ING, ABN AMRO, Actiam, NN, Triodos Investment Management, Rabobank, Robeco, TKP Investments, FMO and Unilever had the objective to “design a methodology broadly supported by pension funds, insurers and banks to measure their contribution to the SDGs focusing on positive impacts”. Their ultimate goal was to support the scaling up of assets that contribute to the SDGs.

The Working Group selected a limited number of impact* indicators per SDG which allow for:

- Comparability and aggregation of impacts;

- Harmonization of data requirements for reporting companies

- Consolidated reporting to stakeholders

*Also contains output and outcome indicators.

The proposed indicators are aligned with the SDG indicators and targets defined by the UN but were re-defined in a way that is more appropriate to the context of investors and companies.

The focus of the indicators selected is to measure the absolute positive impact through products and services. Most indicators are drawn from existing indicator databases (e.g. IRIS, SDG Compass, UN, GRI) and capture tangible impacts (e.g. tons of carbon, m3 of water). Practicability is valued over comprehensiveness, which implies that the proposed indicators will not capture all possible impacts. Investors and companies can choose from the proposed indicators but are also allowed to add other indicators. More information about the proposed indicators and how they have been selected can be found in this publically available guide.

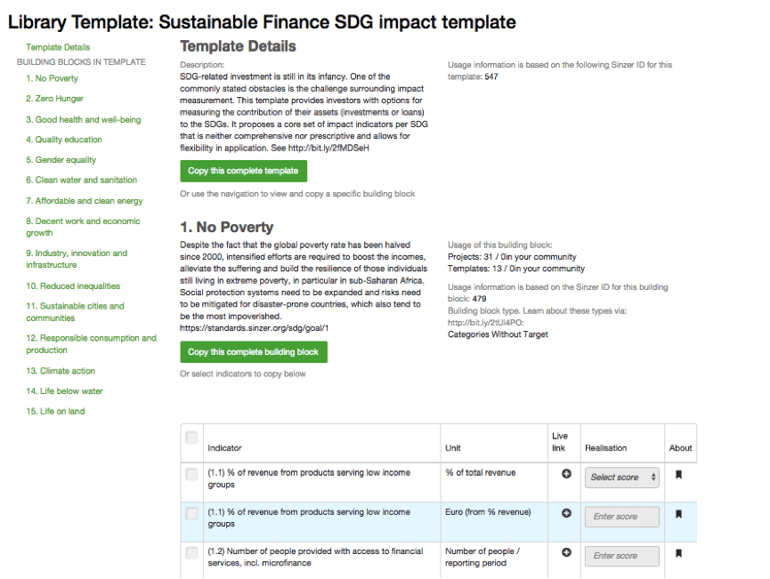

Based upon these indicators, we have developed the Sustainable Finance SDG Impact template. This template is available for users of the Sinzer online impact management tool. Investors and companies can copy and past the complete template or select those SDGs and related indicators that are relevant to their context. In addition, users can add impact indicators using Sinzer’s publicly available Impact Standards search engine: https://standards.sinzer.org and/or other generic indicators to slice and dice the impact data (e.g. asset class, region of impact, etc.)

Once the template is published, users can create projects to manage their impact: Collect, aggregate, analyse and report about impact. One of the first institutional investors now managing their portfolio using Sinzer is the Dutch pension fund PGGM.

Interested?

-1.jpg?width=232&name=GT%20Sinzer_logo_screen_descriptor%20(1)-1.jpg)