Sinzer recently announced the formal Data Partnership with the Global Value Exchange (GVE). We are presenting a series of blogs with more detailed information about the data sources GVE uses to extract outcomes, indicators and valuations from. This week we highlight the IRIS metrics from the Global Impact Investing Network (GIIN), which – through our new data partnership – can now be accessed through the Sinzer platform as well.

IRIS metrics from the Global Impact Investing Network (GIIN) are now available on the Sinzer platform

Topics: Impact investing, indicators, metrics, IRIS

That was the central question of last weeks Round Table we co-organized with Deloitte. Together with 25 professionals from different sectors – impact investors, philanthropists, social enterprises and NGO’s- we shared experiences on the topic of impact measurement and how to account for it.

Topics: Impact measurement, Social impact, Accountability, Social Return on Investment, Impact investing, Social accounting, Social impact management, impact measurement software, Social Value

How can we become data-driven without data driving us crazy?

Impact measurement often requires organisations to collect more data. But with more information, the risk of information overload and attention fragmentation increases. How can we cope? How can we become data-driven without data driving us crazy?

Topics: Impact measurement, Social impact, Stakeholders, Impact investing

The importance of social impact measurement in a Social Impact Bond

The first national Social Impact Bond conference in the Netherlands, organized by START Foundation, is a fact. It was even the first national conference on Social Impact Bonds (SIBs) globally, since SIBs are still a relatively new phenomenal. Worldwide there are nearly 50 SIBs up and running of which 3 are launched in the Netherlands. Clearly, some people think this will become much bigger than it currently is.

Topics: Social impact, Social enterprise, Impact investing, Maatschappelijke business case, philanthropy, overheid, publieke aanbesteding, aanbestedingen, government, Social Impact Bond

5 steps to stay flexible when you use standard impact metrics

What sets you apart? How do you compare to others in your line of work? Why should we invest in you? Impact investors often ask these questions, but don't always have sufficient data with regard to impact to inform their decisions.

Topics: Impact measurement, Accountability, Impact investing, software

More and more people are beginning to understand that impact investing will become a big part of the future of finance. Currently, over 1200 asset owners and investment managers responsible for 60 trillion dollar have become signatories of the UN Principles for Responsible Investments. That’s over 30% of total funds under management!

But have you ever wondered how an investor becomes an impact investor?

Watch this video for a short introduction about social impact investing:

Topics: Impact measurement, Accountability, Impact investing, software

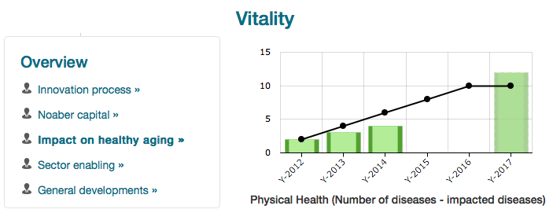

According to a recent JP Morgan/GIIN survey among impact investors, 94% considers measuring social and environmental performance very important because it’s part of their mission. In fact, every impact investor included in this survey thinks impact measurement is important. Most impact investors currently focus on standardised output and outcome indicators to measure their performance, either from the IRIS database or from their own choosing.

Topics: Impact measurement, Social impact, Impact investing

Inequality is the most pressing issue of our times. From Joseph Stiglitz and Oxfam’s recent research to the IMF and the CEO of Goldman Sachs, many are citing it as a critical issue leading to poverty and unstable societies. However, it is not just the broad brush issues that are affected by inequality.

Topics: Accountability, Impact investing

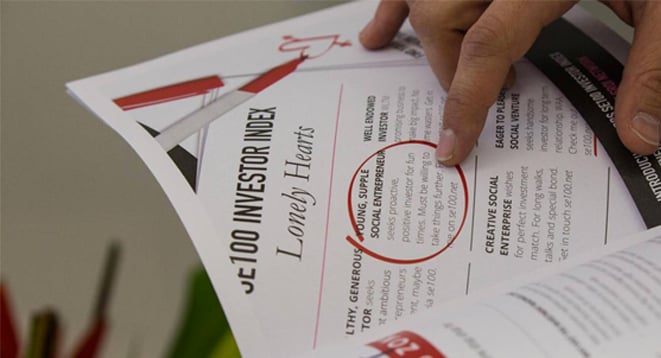

The new SE100 Investor Index rates social investors on their transparency and impact measurement. Co-founder of the index and CEO of The SROI Network, Jeremy Nicholls, says ratings are important to encourage competition and better performance.

Topics: Impact investing

What if the legal and financial protections available to investors were also given to recipients of social returns? Jeremy Nicholls makes the case in his latest blog, and ask if the community share schemes are the answer.

Topics: Value, Impact investing

-1.jpg?width=232&name=GT%20Sinzer_logo_screen_descriptor%20(1)-1.jpg)