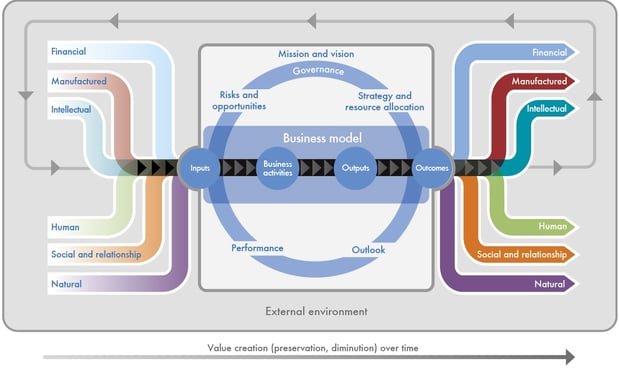

A business creates value through a combination of strategy, governance, performance and prospects in an external environment. A framework that enables a businesses to bring these elements together – and to communicate the value creation story through the ‘connectivity of information’ - is called Integrated Thinking & Reporting, in short <IR>. At the heart of <IR> is an integrated model, which demonstrates how six capitals – financial, manufactured, human, social and relationship, intellectual and natural – represent all the resources organizations utilize to create value (over time).

<IR> reportingToday many listed companies label their annual reports as Integrated Reports, some even before the International Integrated Reporting Council (IIRC) launched the official <IR> framework (in December 2013). These annual reports however, should actually be more considered as combined reporting instead of <IR>, because they combine the financial and the sustainability report into one report. For many of those – and other – companies, how to move forward from “simply” combining information (which can take up months of manual work during the reporting period) to connecting information and truly understanding the value creation process poses a big challenge.

An integrated report conform the <IR> framework communicates how the activities and capabilities of an organization transform the six - or less - material capitals into outcomes. It’s a forward looking, value focused, and holistic way of corporate reporting and provides different audiences with relevant information, preferably digital available, at any time. This is distinctly different from the “old way” of of combining information in corporate reporting, since that way of reporting is still mostly focused on financial value, backward looking with silos of information and provides companies with paper-based PDF’s. Implementing <IR> on the other hand, is not a yearly one off event aimed at disclosing information externally. It’s a continuous way of reporting with the aim to shift financial management into value management.

<IR> thinking and embedding

One of the reasons why organizations are struggling with embedding <IR> is because <IR> is a “principle” based framework and doesn’t include a pre-defined set of KPI’s. An understanding about which capitals are material for your business, how these capitals transform into outcomes (both positive and negative) and how to translate this into value, requires specific skills and is generally not something a reporting department can do itself. It should be on the top priority list of the CFO, because the so-called non-financial capitals – such as natural capital - can turn into financial ones within a day, as we have seen with Volkswagen this week.

Furthermore, there is a need for technology that can align underlying systems and information flows for both internal as external reporting. This week we were invited to the Round Table of the IIRC Tech Initiative were technology firms, the accounting profession and corporates are trying to develop solutions that support the adoption of <IR> in order to enhance (or in some cases restore) accountability, stewardship and trust.

Sinzer encourages this initiative and supports the implementation of the <IR> framework. We therefore offer everyone who wants to embed <IR> in their organization a coupon for a free-of-charge two hours consult in which we explain how to set up your value creation story. Interested?

-1.jpg?width=232&name=GT%20Sinzer_logo_screen_descriptor%20(1)-1.jpg)